No products in the cart.

- Home

- All Passive Income Methods

- Want to See How Much Other People Earned?

- Beginner’s Guide to Passive Income

- My Journey on Passive Income that 99% Population Don’t Hear About

- Litigation Financing – 30% ROI Anyone?

- IPO Under 90 Days!

- IPO Hopeful

- Unicorn Potential?

- An Enjoyable Hobby That Appreciates Too?

- Microlending in Africa

- How You Profit from Beyoncé and Bieber?

- Private Lending

- Tax Lien & Tax Deed in US

- You Can Still Get Bitcoin for $50K???

- A New Strategy with 40%–90% ROI in Year 1

- About Us

- Contact Us

A New Strategy with 40%–90% ROI in Year 1 – 04 Risks and Real ROI

Author: James L

This is the first series contributed by our fans, after we gave the shout-out to our community to submit niche passive income strategies – I hope you find this one insightful as usual!😁 The author of this series is James L.

Continuing from the last post, there is no such thing as absolute certainty, and therefore no perfect investment. Even though the improved flow-through share strategy looks very promising, it can only be said to carry minimal risk—not zero risk. After all, even GICs (Guaranteed Investment Certificates) can default if the issuer can’t pay.

So, where exactly does the risk in improved flow-through shares lie? The government has strict requirements: the funds raised by selling flow-through shares must be used exclusively for mineral exploration. They cannot be used to pay regular employee salaries or bonuses, or to upgrade equipment unrelated to exploration. If the funds are misused, the tax credits will be revoked and cannot be passed on to investors. This is the only real risk involved.

In nearly 30 years and close to 1,000 cases, this has happened only three times. These were very serious incidents: CFOs went to jail or were fired, and without exception, the companies compensated investors out of their own pockets.

This is where the importance of the service companies comes in. When searching for mining companies issuing flow-through shares, the service company must first conduct thorough due diligence to verify the company’s background and assets, ensuring it won’t quickly go bankrupt or get delisted due to a failed exploration or a stock price crash. They also sign contracts with the company to guarantee the proper use of funds. If investors lose their tax credits due to misuse, the company is responsible for all losses, without investors needing to pursue lengthy legal actions.

After all this explanation, here are a few examples to illustrate.

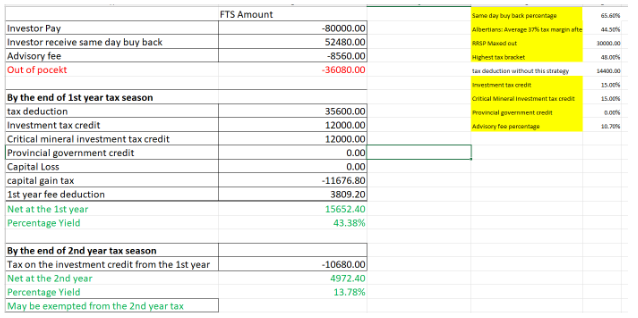

First, let me share an example from Alberta last year. Alberta has relatively high wages but lower tax rates compared to other provinces, and it doesn’t offer provincial tax credits, so the net benefit is lower. However, the first-year return was still 43% (see the chart below for detailed calculations). If you don’t continue investing the second year, the two-year return falls to about 14%. Given that the only risk is the one mentioned above, and your money supports meaningful exploration work rather than being taken by the government to do things you might not approve of, it still seems worth considering.

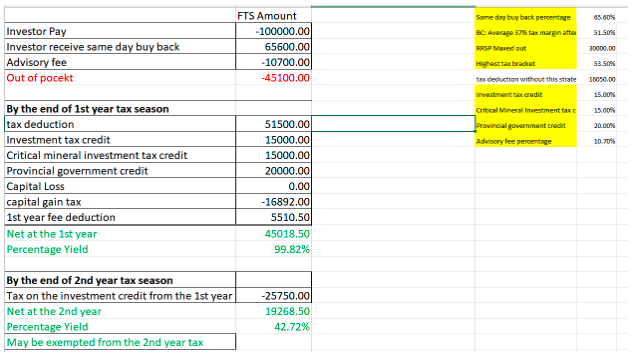

Next, let’s look at an example from British Columbia (BC). BC offers a 20% provincial tax credit, and its provincial tax rate is more than 5 percentage points higher than Alberta’s. As a result, the returns jump dramatically — nearly 100% in the first year, and still around 40% in the second year!

From these examples, we can roughly see the breakdown of how an investor’s money is allocated when purchasing flow-through shares. About 10% goes to the service company, whose role we have mentioned earlier and will not repeat here. Around 35% is the discount given to the liquidity provider. The remaining 55% returns to the investor’s account within about a week, greatly improving cash flow compared to traditional flow-through shares.

When tax season arrives, approximately 15% (which is about 25% multiplied by 65%) of capital gains tax applies. However, investors receive a 30% government incentive for critical minerals, plus about 45% in tax credits. Don’t forget, the service company’s fee (about 5%) is also tax-deductible.

Therefore, even in Alberta, the total investment return in the first year can reach around 20%. If you exclude the immediate cash returned, the first-year investment return is about 40-50%. In the second year, if you don’t reinvest in flow-through shares, the government incentives must be taxed. If your tax bracket that year is low, you can pay it directly. Otherwise, it is recommended to continue investing to defer taxes.

Even at higher tax brackets, the two-year combined return can still be 14% (Alberta) or 42% (BC). In today’s bear market for stocks and real estate, it’s hard to find investments with such cost-effectiveness.

After studying this, I had another question: If I invest enough, can I avoid paying any tax at all? Or at least reduce my tax rate to around 20%, a more reasonable figure? The answer is no. The reasons will be discussed in the next chapter.