No products in the cart.

- Home

- All Passive Income Methods

- Want to See How Much Other People Earned?

- Beginner’s Guide to Passive Income

- My Journey on Passive Income that 99% Population Don’t Hear About

- Litigation Financing – 30% ROI Anyone?

- IPO Under 90 Days!

- IPO Hopeful

- Unicorn Potential?

- An Enjoyable Hobby That Appreciates Too?

- Microlending in Africa

- How You Profit from Beyoncé and Bieber?

- Private Lending

- Tax Lien & Tax Deed in US

- You Can Still Get Bitcoin for $50K???

- A New Strategy with 40%–90% ROI in Year 1

- About Us

- Contact Us

You Can Still Get Bitcoin for $50K??? 8) Should I Buy Coins or Mine?

Continuing from the last post, so should you buy Bitcoin directly on the market at retail price, or mine it yourself at cost? Like I mentioned when calculating returns in episode 6, let’s look at a simple example with one mining rig:

Assuming each Bitcoin is worth $100,000, and buying one mining rig plus a year’s electricity and other costs uses about 0.127 BTC. The rig mines roughly 0.052 BTC per year. So, if you think purely in terms of coins (BTC-denominated), your expected annual return is around 40%–50%.

If you think in fiat term and the Bitcoin price stays stable at $100,000, the expected annual return is also about 40%–50%.

But if you factor in Bitcoin price volatility, roughly speaking:

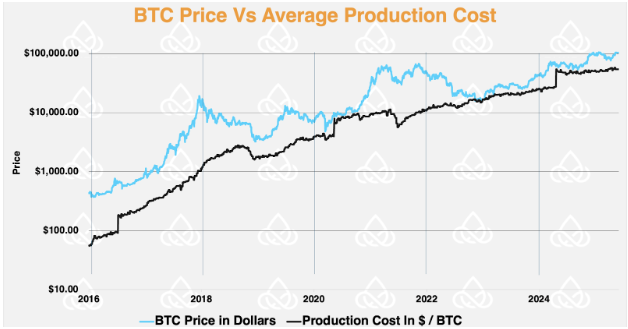

- When BTC price falls below $50,000–$60,000, mining loses money — better to just buy coins.

- When BTC is around $50,000–$60,000, mining breaks even.

- When BTC is above $60,000, buying coins means paying retail price, but mining coins are basically acquired at $50,000–$60,000 wholesale cost, which is great.

Right now, with Bitcoin at $100,000 and mining cost around $50,000, the BTC-denominated return is around 40%–50%, which means you can break even in about 2 to 2.5 years. So, do you want to pay premium at retail price to get BTC today, or spend money upfront to mine and wait for 2.5ish years to recoup your BTC upfront cost and then some more BTC in the future (assuming none of the risks mentioned in my last post materializes)? It really comes down to personal preference.

Of course, this is all before the next halving, which is still a few years away. After halving, the mined coins per rig will be cut in half, but theoretically the price should roughly double, so the return ratio should stay about the same.

Of course, this is theory — the market either surprises you or shocks you 😂

Here’s a chart to show this visually according to Beau:

So if the theory holds, mining may be better than buying. B said that ever since he started mining himself, he hasn’t bought any Bitcoin 😂

But from my perspective, buying is much more expensive upfront, yet it carries no operational or third-party risks. After all, mining takes over two years (theoretically) to break even. The profits are higher but the risks are also greater compared to just buying. So of course, I want to try mining, but I’ll start small — if I lose, I lose 🤦🏻♀️

At the same time, if BTC drops close to that $50k–$60k mining cost level, I’ll still buy on the market (although I don’t really expect the price to fall that far 😂). So my personal plan is to do both — mining and buying.

Plus, my experience so far has been great. After paying, I get notified at every step, and if I need to talk to someone I can easily schedule a chat with operations. It’s very reassuring. Sometimes I even talk to them twice a day. The whole process — from chatting, transferring money, getting the rigs, to setting up and starting mining — took less than a week. So I’m in.

Of course, this is just my way of thinking. If you’re thinking in fiat terms, you have even more to consider to see if this is worth trying.

So if you want to try, how do you start?

Next time — the grand finale!