No products in the cart.

- Home

- All Passive Income Methods

- Want to See How Much Other People Earned?

- Beginner’s Guide to Passive Income

- My Journey on Passive Income that 99% Population Don’t Hear About

- Litigation Financing – 30% ROI Anyone?

- IPO Under 90 Days!

- IPO Hopeful

- Unicorn Potential?

- An Enjoyable Hobby That Appreciates Too?

- Microlending in Africa

- How You Profit from Beyoncé and Bieber?

- Private Lending

- Tax Lien & Tax Deed in US

- You Can Still Get Bitcoin for $50K???

- A New Strategy with 40%–90% ROI in Year 1

- About Us

- Contact Us

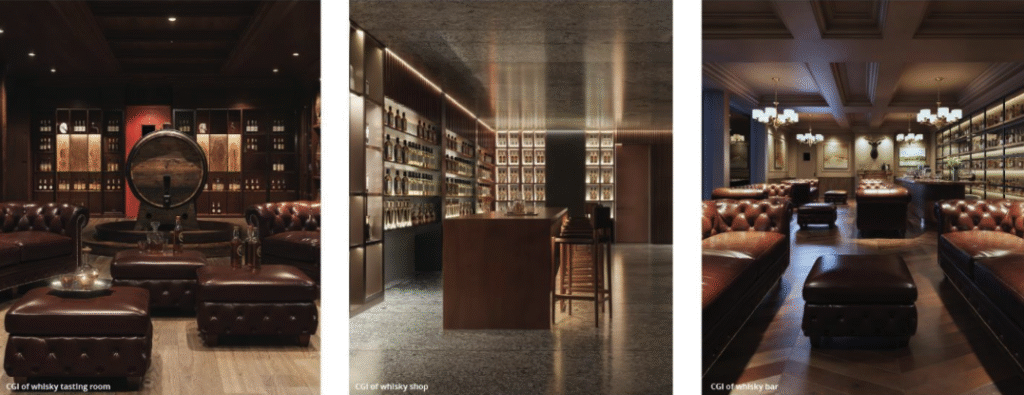

An Enjoyable Hobby That Appreciates Too? (2) – Whisky

Continuing from the last post, let’s start our deep dive into the world of spirit with whisky. Why whisky? Interestingly, it was the last subcategory I invested in—but it gave me the best, most professional, and smoothest experience. So I’m starting with this one.

I worked with a company that offers full-service whisky custody. Of course, custody is just one part of their business—they also have their own award winning bottling company. I dealt with R, who handles investor relations. Right from the start, he gave me his WhatsApp. Despite the time zone difference, every question I asked—whether before or after our first call—got answered within 24 hours.

As someone who barely drinks, I just couldn’t wrap my head around why anyone would buy whisky as an investment, or how it could even be resold at a premium in the secondary market. R just laughed. He explained that the most fundamental factor in this asset class is time. The longer whisky stays in the barrel, the more valuable it becomes. Time = money. As simple as that.

All distilleries, at their core, are businesses. And as businesses, they need cash flow. So distilleries can’t afford to let their products age for too long on their own books—they need to keep selling, generating cash to buy more raw materials and keep the cycle going. That creates an opportunity for arbitrage: investors or intermediaries who don’t need immediate cash flow buy the young spirit and let it age for years—sometimes over a decade. Whether they drink it, collect it, or resell it later, the whisky appreciates in value simply with time.

R told me many people (including himself) buy whisky when their kids are born, so the whisky “ages” alongside the child. When the kid grows up, they can bottle it for the wedding, drink it as a family, or sell part of it. Others buy it as a sort of college fund—sell it when their kid turns 18 to pay for tuition. Of course, many are just in it purely for investment—hold it for 5 years and potentially double their money.

That said, the majority are still end consumers. Fun fact: India is the largest consumer of whisky from this particular region of Scotland—more than the U.S. and Japan combined. They drink over 100 million bottles a year, meaning 1 out of every 2 bottles of this whisky globally goes to India. 😂

I laughed and said, “India aside, buying whisky when your kid is born? That’s just like our tradition of saving Nu’er Hong (daughter’s wine) in Chinese tradition!” Now that I can relate to. 😂

I asked him, “So if you handle full custody, what does the actual process look like?” More on that next time!