No products in the cart.

- Home

- All Passive Income Methods

- Want to See How Much Other People Earned?

- Beginner’s Guide to Passive Income

- My Journey on Passive Income that 99% Population Don’t Hear About

- Litigation Financing – 30% ROI Anyone?

- The Closest I’ve Ever Been to Changing the World

- IPO Under 90 Days!

- IPO Hopeful

- Unicorn Potential?

- An Enjoyable Hobby That Appreciates Too?

- Microlending in Africa

- How You Profit from Beyoncé and Bieber?

- Private Lending

- Tax Lien & Tax Deed in US

- You Can Still Get Bitcoin for $50K???

- A New Strategy with 40%–90% ROI in Year 1

- Year-End Passive Income Playbook Review

- About Us

- Contact Us

A New Strategy with 40%–90% ROI in Year 1 – 05 Finale

Author: James L

This is the first series contributed by our fans, after we gave the shout-out to our community to submit niche passive income strategies – I hope you find this one insightful as usual!😁 The author of this series is James L.

Continuing from the last post, we asked whether it’s possible to invest as much as possible in flow-through shares to fully offset taxes. The answer is no. While the government encourages support for the mining industry, it does not want wealthy individuals to exploit the system to receive a complete tax exemption. This is why there is the Alternative Minimum Tax (AMT).

You can think of AMT as a minimum amount of tax you must pay. The Canada Revenue Agency (CRA) calculates your tax twice: once using the regular method like your tax software does, and once using a specific formula (available online for those interested). If your regular tax payment exceeds the AMT amount, no problem. But if your regular tax is lower, you have to pay at least the AMT amount this year.

Any excess tax credits you don’t use can be carried forward indefinitely or carried back up to three years. CRA has been discussing reforming this formula with frequent changes, but no change has been finalized. A rough rule of thumb is to keep your flow-through share investments at or below 20% of your income to stay safe and avoid affecting normal RRSP contributions.

Finally, I looked into RRSP dissolution — a new application of this method that hasn’t yet been widely adopted. Here’s the only case I know of:

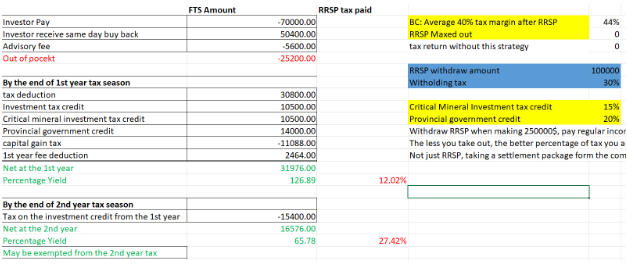

The investor earns $250,000 annually and lives in BC. They want to start withdrawing from their RRSP annually now. Without this method, withdrawals would be taxed at over 45%. Even retiring in a couple of years with an income of $100,000 per year, they would still lose a lot to taxes.

However, by using this method, a large portion of the RRSP can be withdrawn in the first year with an effective tax rate as low as 13%.

Some friends might say, “RRSP withdrawals already count as income, so why bother calculating dissolution separately? Just include it in income tax calculations.” This argument has some merit. However, many people don’t realize the issue until it’s too late — they have too much RRSP and can’t withdraw it efficiently. Since AMT is involved, it’s better to treat dissolution as a separate item to raise awareness.

As for what was mentioned at the beginning of this article — giving the middle class a chance to receive subsidies, and allowing seniors to qualify for full pensions — these situations don’t really apply to improved flow-through shares. But after weighing the pros and cons, interested readers may still consider the original flow-through shares.

Alright, that wraps up this series. I hope it has unlocked a new strategy for everyone and been helpful. If you have a high income and meet the criteria, feel free to contact us for more information so you can get started!