No products in the cart.

- Home

- All Passive Income Methods

- Want to See How Much Other People Earned?

- Beginner’s Guide to Passive Income

- My Journey on Passive Income that 99% Population Don’t Hear About

- Litigation Financing – 30% ROI Anyone?

- The Closest I’ve Ever Been to Changing the World

- IPO Under 90 Days!

- IPO Hopeful

- Unicorn Potential?

- An Enjoyable Hobby That Appreciates Too?

- Microlending in Africa

- How You Profit from Beyoncé and Bieber?

- Private Lending

- Tax Lien & Tax Deed in US

- You Can Still Get Bitcoin for $50K???

- A New Strategy with 40%–90% ROI in Year 1

- Year-End Passive Income Playbook Review

- About Us

- Contact Us

You Can Still Get Bitcoin for $50K??? 6-Mining Cycle, Returns, and ROI?

Continuing from the last post, let’s dive straight into numbers.

According to B, each mining machine (ballpark estimate depending on the model) can mine about 0.052 BTC per year assuming around 90% uptime. The cost of the machines varies with market conditions. For example, right before a major bull market, each machine might cost somewhere between $5,000 and $10,000 USD. In a bear market, prices are lower; during a bull run, they spike.

Now here’s something most people miss: mining isn’t an “investment” per se—it’s an operational business. That means expenses like electricity, hardware, and maintenance aren’t just costs—they’re deductible. You can write them off and amortize them.

So instead of treating mining as a capital investment (like buying Bitcoin outright), it’s classified as active business income—which can bring major tax advantages. This means your returns actually come from three sources:

- The BTC you mine

- The resale value of your machines

- The tax savings from operating a business

Let’s break it down.

1. BTC Mining Returns

If you believe Bitcoin will appreciate and plan to HODL, then it makes no sense to calculate returns in fiat (dollar-based). You have to adopt a BTC-denominated mindset. That means you don’t care what the price of Bitcoin is today or tomorrow—you only care whether the number of coins you own is increasing.

From a BTC-based perspective, if the amount of Bitcoin you mine over time exceeds the amount it cost you (in BTC) to buy the machines in the first place, you’ve made a profit.

Of course, making the mental shift from fiat thinking to crypto thinking takes time. For me, it took about 8 years to fully internalize. And this shift only happened because I’d spent just as many years studying Bitcoin, the technology, the community, the macro backdrop—until I reached a level of conviction that made sense for me. It might not be right. It definitely isn’t for everyone. As I’ve said countless times: I can only be responsible for my own money. My framework works for me, given my financial situation and worldview. I don’t speak for anyone else, and I don’t give advice—this is purely a personal perspective.

2. Mining Rig Resale Value

This is the hidden piece people often overlook.

In a bull market, demand for miners goes up, so does the price of new machines—and the secondhand market heats up too. I’ve even heard stories of people selling old rigs (on their last legs, practically ready for retirement!) for more than what they originally paid. 😂

It reminds me of how, during COVID, friends of mine sold second hand cars and even used yachts for more than they bought them for. Will there be another “COVID”? Another epic bull market? Who knows.

Even if you don’t sell at a premium, there’s still some salvage value. B mentioned that supposedly, at the end of year one, a mining rig can still be worth 60–75% of its original price—which can significantly offset your cost basis.

Now for the third part—we’ve got to do the math.

Most people don’t realize that mining is a business, not an investment—so they completely overlook how much tax efficiency can boost your actual returns.

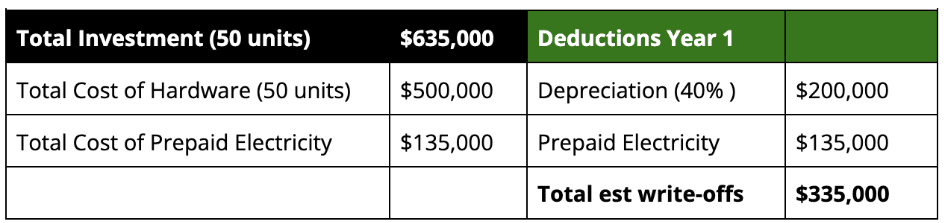

Let me show you the numbers B shared with me:

Take these numbers as an example. So let’s say someone buys 50 mining machines.

Just in the first year alone, the amount you can write off—conservatively—is over $300,000. 😂

Depending on whether you’re taxed at a corporate or personal rate, that could translate to $50,000 to $170,000 in tax savings!

Now that we’ve covered all three sources of return, let’s take a closer look at the actual inputs, outputs, and returns from mining.

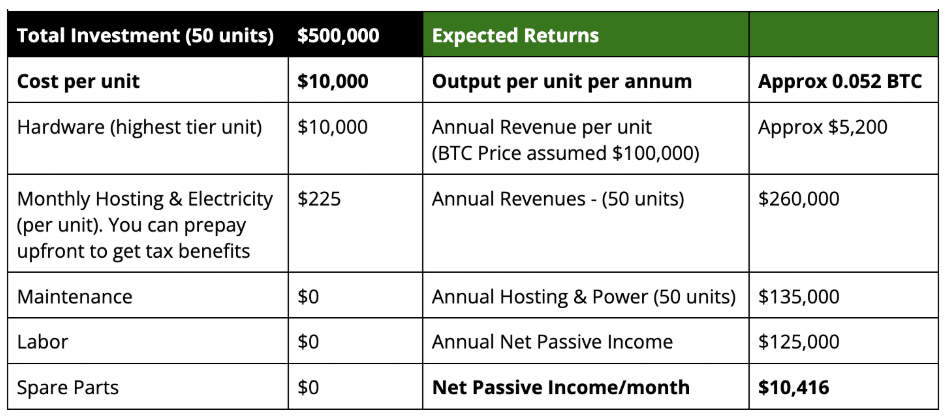

Here are the raw numbers B shared with me:

Let me walk through a few key numbers from B’s projections. 😂

At the high end, each mining machine costs around $10,000, and each one can mine approximately 0.052 BTC per year. Monthly costs—including electricity, repairs, maintenance, and hosting—are bundled into a flat rate of $225 per machine.

You can start mining with just one machine, or go big. For example, if your goal is to mine 1 full BTC per year, you’d need about 20 machines. It’s flexible—go as big or small as you want, you can get 1 machine, or you can get hundreds of them.

Let’s break it down using the simplest case: 1 machine.

Assuming BTC is priced at $100,000, and you’re calculating in BTC terms:

- Cost of machine + one year of operations = ~0.127 BTC

- Annual output = ~0.052 BTC

So in BTC terms, B said your projected return is 40%–50% per year.Even in fiat terms, assuming BTC stays flat at $100K, the return is still about 40%–50% annually.

Now if you’re calculating in fiat and BTC price fluctuates:

- At $50K–$60K BTC, mining starts to break even or lose money—you’d be better off just buying Bitcoin.

- But once BTC goes above $60K, mining becomes wholesale pricing while the market pays retail. That’s when it gets fun.

So with today’s numbers—let’s say $100K BTC, $50K mining cost per BTC mined—you’re effectively generating BTC at half the market price.

That means an ROI of 40%–50%, and a 2 to 2.5 year break-even period in both fiat and BTC terms according to what B indicated.

And remember, this is only counting the BTC mined (the first of the three income sources we mentioned).

If you factor in:

- Machine resale value

- Tax savings from depreciation/write-offs

…then the real return is even higher.

So how much higher?

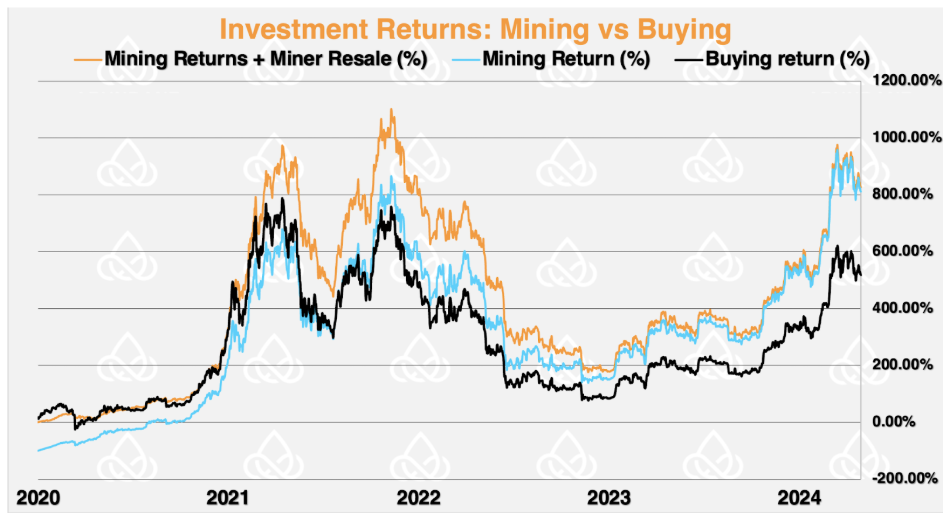

So basically, from 2020 to 2024, the total return from just holding Bitcoin was around 500% (which is about 100%+ annualized), while mining brought a total return of about 800% (roughly 150%+ annualized). If you also sold the mining rigs afterward, the total return jumps to around 900% (about 200%+ annualized) 😂

Of course, these charts definitely pick the best-performing periods—perfect timing for buying low and selling high (which also explains why mining rigs could be sold at a good price). So, don’t get too fixated on these exact numbers.

For me personally, I’m okay even if returns drop from 100% to 50%. I still want to try. And I stick to my usual approach: small amounts, diversified, lots of experiments, letting time sort out the winners. I review once a year — if it’s profitable, I add more; if it’s losing, I cut my losses.

Now that we’ve covered expected returns, it’s time for my favorite part of every new series — next time, we’ll talk about mining risks, haha!