No products in the cart.

30% ROI Anyone? (1) – How Did I Find This?

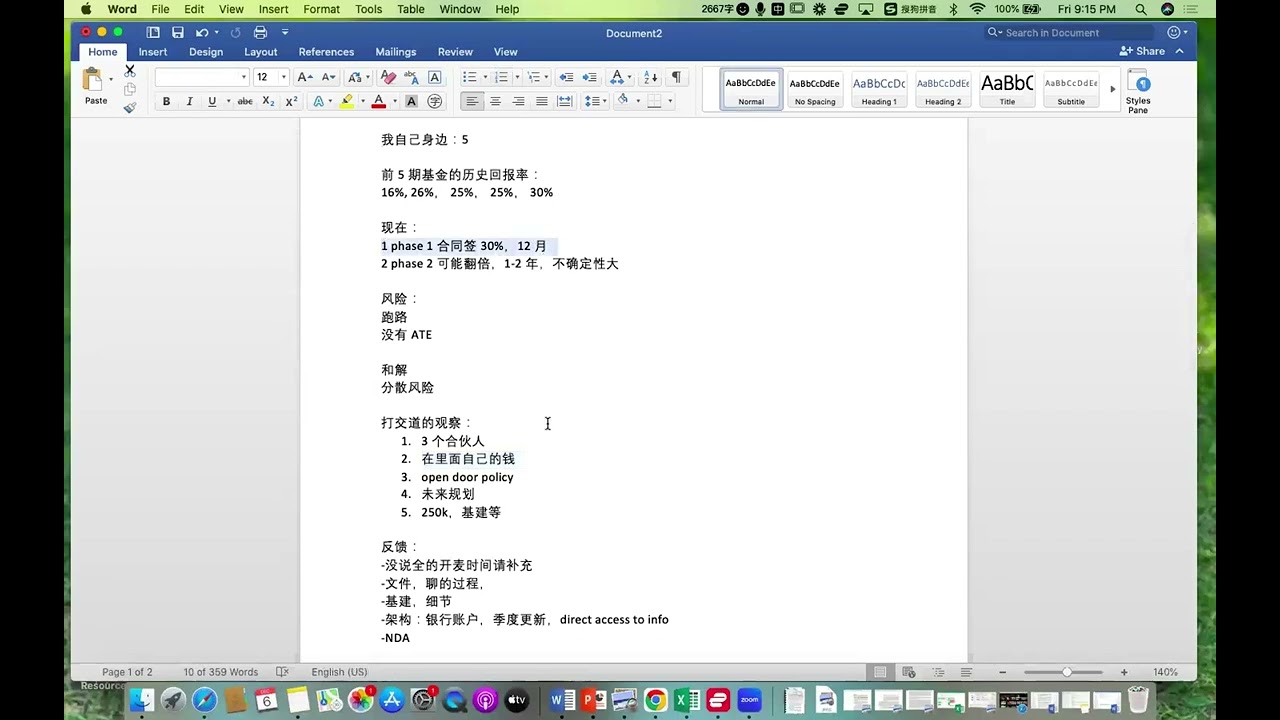

You might know that my main source of passive income is legal lending (the details are in the series “99% Population Don’t Hear About” which yields 10%+ annually on 6 month term, and if you didn’t read this series, feel free to reach out to us and we will share it with you), and in the past ten years, I’ve only met one other person in this field. It’s quite rare to find anyone else doing this. Whenever I talk about it, people find it a bit magical, because unless you had a car accident like I did and stumbled upon this opportunity, you...